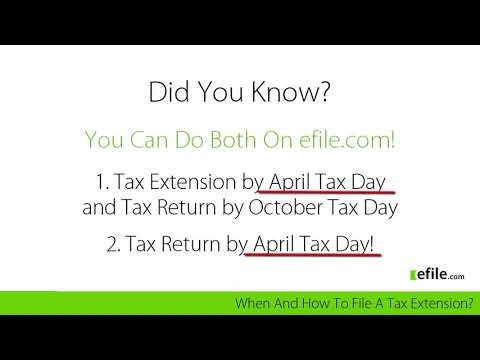

Music, if you are unsure whether you should file an IRS and/or state tax extension or tax return, ask yourself this question: do you think filing a tax extension postpones your deadline to pay the taxes you owe without IRS penalty? Unfortunately, it does not. To be clear, a tax extension only postpones your time to file a return, not the time to pay your taxes. So let's compare your options. - You should e-file a tax extension if you don't have all your tax records by the April deadline. - You should not file a tax extension simply because you don't have the money to pay your taxes. Instead, file a tax return and pay as much as you can. - If filing tax returns and tax extensions on a file com or easy start, by creating an account or signing back into your existing account. - For a tax extension, click on the "My Return" on the top left and click on the green "Need an Extension" button. Follow the on-screen instructions to prepare and e-file your tax extension. - If you would like to prepare and e-file your tax return instead, click on the "Name and Address" tab and follow the tax return questionnaire. - Keep in mind that not filing a tax return or tax extension by the April deadline may result in higher penalties and interest on those penalties for not paying the taxes you owe. So just file and pay as much as you can. - If you don't file a tax return or tax extension by the tax date deadline, you may be subject to late or failure to file penalties. - If you don't pay the total taxes you owe by the April deadline, you may be subject to late or failure to pay penalties and interest. -...

Award-winning PDF software

Irs 1099 extension online Form: What You Should Know

Form 4868 with the IRS every year beginning February 14, 2022. See Form 4868 page below. Form 4868, Application for Automatic Extension of Time Sep 13, 2025 — When you receive Form 4868, download and complete and e-file Form 1040, 1040NR or 1040NR-EZ at . About the U.S. Postal Service — USPS The Postal Service is an independent agency of the U.S. government, created by Congress in 1775. You can order any mail order item using the U.S. Postal Service website http:// or by calling. Federal Income Tax In the United States, the individual and all nonresidents are subject to a personal income tax rate of 33.33, which is the highest rate, and a corporate income tax rate of 35 percent, the second highest. Form 1040 (Amended and Simplified Income Tax Guide) — U.S. Department of the Treasury Form 1040NR(S) (Standard) — U.S. Department of the Treasury Form 1040(S) (Summons) — U.S. Department of the Treasury Form 1040-ES (Employer's Withholding Allowance Tax, or Tax After July 1, 2015, and Prior) — U.S. Department of the Treasury Form 1040-ESA (Effective Date) — U.S. Department of the Treasury Form 1040A (U.S. Tax Payment Due Date) — U.S. Department of the Treasury Form 1120S (Payments Due on Your U.S. Tax Return) — U.S. Department of the Treasury Form 1120S-EZ (Tax Withholding for Individual Over 65 Years of Age) — U.S. Department of the Treasury Form 940-W (Wage and Tax Statement) — U.S. Department of the Treasury Form W-2A (U.S. Wages, Tax, and Social Security Statement) — U.S. Department of the Treasury Form W-2B (Statement of Wage and Tax Withheld) — U.S. Department of the Treasury Form W-2C (Statement of Wages, Tax, and Social Security Withheld) — U.S.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8809, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8809 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8809 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8809 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs 1099 extension online