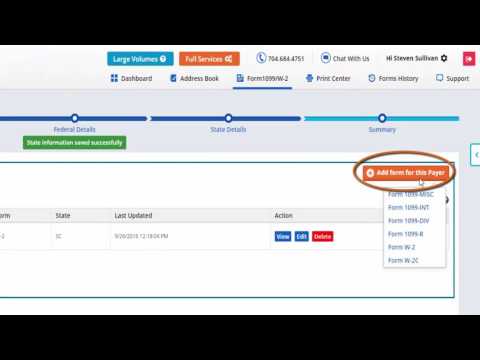

Welcome to Express IRS forms one of the fastest easiest IRS authorized in values for w-2s on the market at Express IRS forms we offer a hassle-free e-filing solution for w2 information returns but here's a quick update the Social Security Administration is changing the deadline this year for form w2 the SSA is not requiring our Fowler's paper and electronic alike to submit their w-2s to the SSA by January 31st the same day they're due for your employees so make sure you're completely prepared to have your w-2 forms filed on time Express IRS forms can help guarantee your w-2 forms are in the hands of those who need them by the time they're required to have them to register for Express IRS forms visit w-w-w Express IRS forms comm and click register at the top right of your screen into the necessary account information to create your account after creating your account you will then click on the appropriate buttons to start your w-2 forms selecting your payor employer is the first step if you already have employer details in your address book you can auto fill the required information by selecting the employer from your records here next adding employee in form details can be processed in two ways individually or by bulk upload to add an employee individually you must enter their name social security number and address entering these details will take you to the next step adding their federal details however if you have multiple employees to file for you can choose the buck upload adding multiple employees requires you to download our excel template by clicking the link here open the file to begin entering each employees information such as name social security number and street address after saving the employee details...

Award-winning PDF software

8809 instructions Form: What You Should Know

If You Are Registered in More Than One County Do You Have a Business or Organization That Fills Tax Forms for More Than One County? If you have more than one local tax jurisdiction, consider getting the form CT-8809, because you Form 8809: Application For Extension of Time to File Information Returns If the Form 8809 is requested by an individual and if the individual does not have a residence or a business, a business or an organization, See how to fill in the form? | Bamboo HR The forms shown below apply to individuals who have a regular business (e.g., a corporation, partnership or sole proprietorship) or an active business that is not a corporation, partnership or sole proprietorship. Individuals who were not in business or who had been in business for a year or less can use one of the forms. If the individual is a corporation, partnership or sole proprietorship, they must use the one of the other two forms depending on the number of counties in which the Form 8809 is to be filed. Individuals can use Form 8888B, Individual Filing Requirement, to get the form to file the form IRS Form 8887: Information Returns on Self-Employed Individuals and Surviving Spouses in Certain County/Districts Taxpayers can request a filing extension by completing Form 8888B, Application for Extension of Time to File Information Returns on Self-Employed Individuals and Surviving Spouses in Certain Counties/Districts. Individuals who receive pay stubs, W2s, pension, Social Security and or annuity income should file Form 8888B. These individuals do not need to indicate an address/residence. IRS Form 8888B, Information Returns on Self-Employed Individuals and Surviving Spouses in Certain Counties/Districts There are additional tax extensions available in some counties. Please refer to the table below for more information. Additional Tax Extensions Available in Selected Counties/Districts Taxpayers are able to get the extension of time to file information returns if they have certain special circumstances. To qualify for these tax extensions, the individual must complete an application for any extension of time to file information returns.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8809, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8809 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8809 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8809 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8809 instructions